1. Aggregate Demand relation: is the total demand for final goods and services in the economy (Y) during a specific time period. In a general aggregate supply-demand chart, aggregate demand (AD) slopes downward. An aggregate demand curve is the sum of individual demand curves for different sectors of the economy. The aggregate demand has five main parts:

where

· is consumption = ac Y+ bc*(Y - T),

· is Investment,

· is Government spending,

· is Net export,

· is total exports, and

· is total imports = am + bm*(Y - T),.

It is the demand for the gross domestic product of a country when, and only when, it is in equilibrium.

In Keynesian economics, not all of gross private domestic investment counts as part of aggregate demand. Much or most of the investment in inventories can be due to a short-fall in demand (unplanned inventory accumulation or "general over-production"). The Keynesian model forecasts a decrease in national output and income when there is unplanned investment. (Inventory accumulation would correspond to an excess supply of products; in the National Income and Product Accounts, it is treated as a purchase by its producer.) Thus, only the planned or intended or desired part of investment (Ip) is counted as part of aggregate demand. http://www.thefreedictionary.com/

So for example, the “X” economy has the following figures:

· = ac Y+ bc*(Y - T)

= .6 (460) + .4 (460- 160)

= 396

· = 125,

· = 350,

· = 200

We can calculate the Aggregate Demand =

856 = 396+125+135+200

Assuming the expectations are equal through time so the aggregated demand equals the total production.

2. Animal Spirits: The name Keynes gave to one of the essential ingredients of economic prosperity: confidence. According to Keynes, animal spirits are a particular sort of confidence, "naive optimism". He meant this in the sense that, for entrepreneurs in particular, "the thought of ultimate loss which often overtakes pioneers, as experience undoubtedly tells us and them, is put aside as a healthy man puts aside the expectation of death". Where these animal spirits come from is something of a mystery. Certainly, attempts by politicians and others to talk up confidence by making optimistic noises about economic prospects have rarely done much good.

http://www.Economics.com

"Most, probably, of our decisions to do something positive, the full consequences of which will be drawn out over many days to come, can only be taken as the result of animal spirits - a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities."

(Keynes, J. M. (1936) The General Theory of Employment Interest and Money, pp. 161-162)

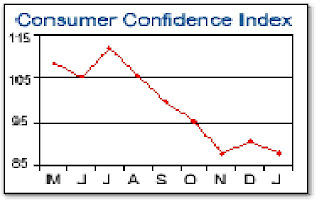

A good example of this is the Consumer´s Confidence Index, a survey by the Conference Board that measures how optimistic or pessimistic consumers are with respect to the economy in the near future.

The idea is that if the consumers are optimistic, they will tend to purchase more goods and services. This increase in spending will inevitably stimulate the whole economy.

Here is an abstract of the recent behavior of this Index:

The Conference Board Consumer Confidence Index Declines in January

January 29, 2008

The Conference Board Consumer Confidence Index, which had improved moderately in December, gave back the gain in January. The Index now stands at 87.9 (1985=100), down from 90.6 in December. The Expectations Index declined to 69.6 from 75.8. The Present Situation Index, however, increased to 115.3 from 112.9 in December.

Consumers' appraisal of present-day conditions, despite the slight improvement, is less than favorable. Those claiming business conditions are "bad" rose to 20.0 percent from 18.8 percent, while those claiming business conditions are "good" decreased to 20.7 percent from 21.2 percent. Consumers' assessment of the job market was slightly more positive. The percentage of consumers saying jobs are "hard to get" eased to 20.1 percent from 22.7 percent, while those claiming jobs are "plentiful" edged up to 23.9 percent from 23.6 percent in December.

Consumers' short-term outlook, which had improved moderately in December, turned more pessimistic. Those expecting business conditions to worsen over the next six months increased to 16.0 percent from 14.1 percent, while those anticipating business conditions to improve decreased to 11.6 percent from 13.8 percent. The outlook for the labor market was also less favorable. The percent of consumers expecting fewer jobs in the months ahead rose to 21.5 percent from 19.9 percent, while those anticipating more jobs eased to 10.5 percent from 10.9 percent. The proportion of consumers expecting their incomes to increase declined to 17.6 percent from 20.2 percent.

where

· is consumption = ac Y+ bc*(Y - T),

· is Investment,

· is Government spending,

· is Net export,

· is total exports, and

· is total imports = am + bm*(Y - T),.

It is the demand for the gross domestic product of a country when, and only when, it is in equilibrium.

In Keynesian economics, not all of gross private domestic investment counts as part of aggregate demand. Much or most of the investment in inventories can be due to a short-fall in demand (unplanned inventory accumulation or "general over-production"). The Keynesian model forecasts a decrease in national output and income when there is unplanned investment. (Inventory accumulation would correspond to an excess supply of products; in the National Income and Product Accounts, it is treated as a purchase by its producer.) Thus, only the planned or intended or desired part of investment (Ip) is counted as part of aggregate demand. http://www.thefreedictionary.com/

So for example, the “X” economy has the following figures:

· = ac Y+ bc*(Y - T)

= .6 (460) + .4 (460- 160)

= 396

· = 125,

· = 350,

· = 200

We can calculate the Aggregate Demand =

856 = 396+125+135+200

Assuming the expectations are equal through time so the aggregated demand equals the total production.

2. Animal Spirits: The name Keynes gave to one of the essential ingredients of economic prosperity: confidence. According to Keynes, animal spirits are a particular sort of confidence, "naive optimism". He meant this in the sense that, for entrepreneurs in particular, "the thought of ultimate loss which often overtakes pioneers, as experience undoubtedly tells us and them, is put aside as a healthy man puts aside the expectation of death". Where these animal spirits come from is something of a mystery. Certainly, attempts by politicians and others to talk up confidence by making optimistic noises about economic prospects have rarely done much good.

http://www.Economics.com

"Most, probably, of our decisions to do something positive, the full consequences of which will be drawn out over many days to come, can only be taken as the result of animal spirits - a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities."

(Keynes, J. M. (1936) The General Theory of Employment Interest and Money, pp. 161-162)

A good example of this is the Consumer´s Confidence Index, a survey by the Conference Board that measures how optimistic or pessimistic consumers are with respect to the economy in the near future.

The idea is that if the consumers are optimistic, they will tend to purchase more goods and services. This increase in spending will inevitably stimulate the whole economy.

Here is an abstract of the recent behavior of this Index:

The Conference Board Consumer Confidence Index Declines in January

January 29, 2008

The Conference Board Consumer Confidence Index, which had improved moderately in December, gave back the gain in January. The Index now stands at 87.9 (1985=100), down from 90.6 in December. The Expectations Index declined to 69.6 from 75.8. The Present Situation Index, however, increased to 115.3 from 112.9 in December.

Consumers' appraisal of present-day conditions, despite the slight improvement, is less than favorable. Those claiming business conditions are "bad" rose to 20.0 percent from 18.8 percent, while those claiming business conditions are "good" decreased to 20.7 percent from 21.2 percent. Consumers' assessment of the job market was slightly more positive. The percentage of consumers saying jobs are "hard to get" eased to 20.1 percent from 22.7 percent, while those claiming jobs are "plentiful" edged up to 23.9 percent from 23.6 percent in December.

Consumers' short-term outlook, which had improved moderately in December, turned more pessimistic. Those expecting business conditions to worsen over the next six months increased to 16.0 percent from 14.1 percent, while those anticipating business conditions to improve decreased to 11.6 percent from 13.8 percent. The outlook for the labor market was also less favorable. The percent of consumers expecting fewer jobs in the months ahead rose to 21.5 percent from 19.9 percent, while those anticipating more jobs eased to 10.5 percent from 10.9 percent. The proportion of consumers expecting their incomes to increase declined to 17.6 percent from 20.2 percent.

3. Bank Run: Bank run (also known as a run on the bank) is a type of financial crisis. It is a panic which occurs when a large number of customers of a bank fear it is insolvent and withdraw their deposits. A run on the bank begins when the public begins to suspect that a bank may become insolvent. As a result, individuals begin to withdraw their savings. This action can destabilize the bank to the point where it may in fact become insolvent. Banks retain only a fraction of their deposits as cash ( fractional-reserve banking): the remainder is issued as loans. As a result, no bank has enough reserves on hand to cope with more than the fraction of deposits being taken out at once. As a result, the bank faces bankruptcy, and will 'call in' the loans it has offered. This can cause the bank's debtors to face bankruptcy themselves, if the loan is invested in a plant or other items that cannot easily be sold.

These are some relative examples of this phenomenon:

In early August 2007, the American firm, Countrywide Financial suffered a bank run as a consequence of the subprime mortgage crisis. On 13 September 2007, the British bank Northern Rock arranged an emergency loan facility from the Bank of England, which it claimed was the result of short-term liquidity problems. The bank's defenders claimed its cash shortage was the result of over-exposure to the failing US sub-prime mortgage market, while its critics argued that it was the result of NR's own careless lending practices.. A run began the following day, Friday, with reports of its internet banking site being overloaded, and long queues outside branches that day, Saturday morning and the following Monday. News reports on 17 September stated that an estimated £2 billion GBP of retail deposits had been withdrawn by customers since the bank had applied for emergency funds.

Later that day the Chancellor of the Exchequer, Alastair Darling, announced that the Treasury would guarantee all currently deposited savings held with Northern Rock, exceeding the pre-existing capped guarantee of £31,700 per depositor per institution offered by the Financial Services Compensation Scheme. This had the effect of ending the run.

The free dictionary

So for example if a Bank is required to keep 15% of the capital aside as a reserve ratio for every loan (assuming all loans have a relative good quality) that means that if the total amount of loans is 100, and the depositors wish to withdraw their money all at once, the bank will only have in cash 15, and since it wont be enough for everyone a bank run will start.

4. Bond: A debt investment in which an investor loans money to an entity (corporate or governmental) that borrows the funds for a defined period of time at a fixed interest rate. Bonds are used by companies, municipalities, states and U.S. and foreign governments to finance a variety of projects and activities.

http://www.thefreedictionary.com/

Example, Sabritas s.a. de c.v. issues a bond with the following characteristics: Face Value 250 pesos , 10 year, semi annual coupon, 20%.

The interest rate could be considered high, because it has to reflect the company quality, Sabritas is a new Spanish company and 10 years might be long enough to imply risk which would have to be compensated by the issuer.

5. Capital Account: The capital account is one of two primary components of the balance of payments, the other being the current account. The capital account records all transactions between a domestic and foreign resident that involves a change of ownership of an asset. It is the net result of public and private international investment flowing in and out of a country. This includes foreign direct investment, plus changes in holdings of stocks, bonds, loans, bank accounts, and currencies. From a domestic point of view, a foreign investor acquiring a domestic asset is considered a capital inflow, while a domestic resident acquiring a foreign asset is considered a capital outflow. Along with transactions pertaining to non-financial and non-produced assets, the capital account may also include debt forgiveness, the transfer of goods and financial assets by migrants leaving or entering a country, the transfer of ownership on fixed assets, the transfer of funds received to the sale or acquisition of fixed assets, gift and inheritance taxes, death levies, patents, copyrights, royalties, and uninsured damage to fixed assets.

http://www.thefreedictionary.com/

Example

The following transactions affect Brazilian Capital Account:

* Brazilian international company buys new buildings in Mexico -$100 (outflow)

* American Investors buys Brazilian Government Bonds +$370 (inflow)

* Canadian car company buys an manufacture plant in Brazil +$700 (inflow)

* Brazilian government buys Chinese computer systems -$640 (outflow)

-------------------------

The Brazilian Capital Account would be = +$330

6. Debt to GDP ratio: Debt-To-GDP Ratio is a measure of a country's federal debt in relation to its gross domestic product (GDP). By comparing what a country owes and what it produces, the debt-to-GDP ratio indicates the country's ability to pay back its debt. The ratio is a coverage ratio on a national level. http://www.investopedia.com/

Example:

Here is a fraction of the article “Macroeconomic Situation and External Debt in Latin America” http://www.imf.org/external/np/speeches/2006/020106.htm

…. So to achieve a position from which counter-cyclical fiscal policy can operate, there is a need to reduce debt to manageable levels over the medium term and thus enable built-in stabilizers to offset part of the impact of shocks. Brazil's efforts to reduce its debt burden by maintaining a high primary surplus, and by restructuring its debt, both in terms of its maturity structure and its foreign currency exposure.

Several other countries have similarly been seeking to reduce their debt burdens. Indeed, between 2003 and 2005, the average primary surplus in Latin America was 3.25 percent—double the average of the previous decade and marking a better performance than in most other emerging markets. But that only brought average debt to GDP ratios down from 65.5 percent of GDP in 2003 to 52.3 percent in 2005, still above the level of a decade earlier.

Although as I noted earlier Brazil has made great strides in reducing its debt to GDP ratio from more than 65 percent in 2002: it is a little over 50 percent.

Similarly, Mexico has reduced its debt to GDP ratio by about 10 percentage points from the levels of the late 1990s: but the ratio is still around 45 percent.

Colombia's debt to GDP ratio is on a declining path: but at around 50 percent of GDP it is still close to double the level of a decade ago.

Bolivia and Uruguay both have debt ratios of around 70 percent of GDP.

In some Central American and Caribbean countries, debt to GDP remains at uncomfortably high levels. Jamaica, for example, has public debt close to 140 percent of GDP; and Panama's debt to GDP ratio is still above 70 percent as of 2004, the latest year for which we have figures….

7. effective demand: Effective demand (in macroeconomics usually regarded as synonymous with aggregate demand), is an economic principle that suggests consumer needs and desires must be accompanied by purchasing power (money) to be considered effective in discussions of supply and demand for the determination of price (http://en.wikipedia.org/wiki/Effective_demand)

A key conceptual notion of Keynesian economics stipulating that the aggregate expenditures on real production is based on existing or actual income rather than the income that would be generated with full employment of resources. Effective demand is embodied in the aggregate expenditures line, which has a positive slope, but a slope of less than one.

(http://www.amosweb.com/cgi-bin/awb_nav.pl?s=wpd&c=dsp&k=effective+demand)

Example: while demand is defined as the goods and services consumers are willing and able to buy at a given price effective demand incorporates purchasing power by taking account of consumers’ ability to buy. In a developing country an individual may demand 10kgs of food per day but may only be able to afford 5kgs per day. Hence here the effective demand is 5kgs while the actual demand is 10kgs.

8. deflation: is the opposite of inflation. It refers to a decrease in the general price level over a period of time (Barro and Grilli 1994, p. 142).

Example: Following the Wall Street Crash in 1929 the US experienced deflation of approximately 10% p.a. during the period from 1930-1933 (http://www.wikipedia.org/). Say that in Ireland the annual rate of deflation is 4%. This means that goods costing €100 this year will cost around €96 next year.

9. consumption function: The consumption function can be written as C = α +mpc X Yd , where α is the intercept term, Yd is disposable income (ie gross income (Y) less taxation (T)) and mpc is the marginal propensity to consume. C is consumption expenditure (Leddin, A. and Walsh, B. (2003), p.49).

Example:

The function represents a linear relationship between consumer expenditure and disposable income. The intercept term is seen as an autonomous spending element. The graph of this relationship is a straight line with slope equal to mpc. Given the following data what is α equal to?

Table 1.

C =5,000

Yd =7,000

Mpc* =0.6

α =?

Solve for α: C = α + mpc X Yd

= 5000 = α + (0.6)(7000)

= 5000 = α + 4200

= α = 800

The graph below is found by solving for a second point in the line taking Yd as 8,000.

Figure 1 Sample Consumption Function

*calculated by ΔC/ΔYd

10. consumer price index: An inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food, and transportation. The CPI is published monthly and is also called the cost-of-living index.

(http://www.investorwords.com/1062/Consumer_Price_Index.html).

Example: In Ireland the Central Statistics Office (CSO) collects approximately 50,000 price quotations from a fixed panel of service and retail providers. These prices are averaged on the basis of their relative importance. The base year of measurement is set to 100. Subsequent changes are compared relative to this base year.

11. investment function: Economics concept which explains how the changes in national income induce changes in investment patterns in the national economy. It is often written as a function of income (Y) and interest rates (r). ie .I=f(Y,r)

http://www.businessdictionary.com/definition/investment-function.html

Example: The introduction of the IFSC in Ireland in 1987 saw huge increased investment as due to a lower rate of corporation tax companies annual income was increased.

12. fiscal expansion: raises aggregate demand through (1) increasing government is purchases, with taxes unchanged or (2) by cutting taxes or increases transfer payments, people's disposable income rises, and they will spend more on consumption. This rise in consumption will, in turn, raise aggregate demand. http://www.econlib.org/library/Enc/FiscalPolicy.html

Example: Recent expansionary fiscal policy in the US has seen the Government increase spending (via tax rebates) to shift the aggregate demand curve to the right and prevent a recession.

13. GDP deflator: or implicit price deflator for GDP, is a measure of the change in prices of all new, domestically produced, final goods and services in an economy. The GDP deflator equals [(Nominal GDP/Real GDP)*100].

http://en.wikipedia.org/wiki/GDP_deflator

Example: Using the GDP deflator nominal GDP is deflated into real terms. So if real GDP equals €200bn and Nominal GDP equals €220bn then the deflator is 110.

14. Imports: The total goods and services that a country purchases from other countries (Parkin 2003, p.436).

For example, the United Kingdom is Ireland’s largest trading partner, and accounts for 31% of total Irish imports. Furthermore, in 2003 alone the UK-sourced imports grew by a staggering 9% to reach €16 billion (http://www.finfacts.com/).

15. Monetary Contraction: refers to monetary policy that seeks to reduce the size of the money supply. In most nations, monetary policy is controlled by either a central bank or a finance ministry (http://www.wikipedia.org/).

One of the greatest examples of monetary contraction occurred in the US in the early 1930s. Effectively, the federal government placed a sizable tax on bank checks which resulted in the massive switch in from bank deposits to currency (Lastrapes and Selgin, 1996).

16. Nominal GDP: The value of the final goods and services produced in a given year valued at the prices that prevailed in that same year (Parkin 2003, 441).

(http://www.wikipedia.com/)

The above table illustrates the rankings of the top five counties of the world by their Gross Domestic Product (nominal) per capita for 2006. It is important to note that the data sourced is calculated with respect to a country’s average population. With respect to Ireland, its low population and attractive corporation tax environment justify its current ranking.

17. Propensity to Consume: The fraction of a change in disposable income that is consumed. It is calculated as the change in consumption expenditure divided by the change in disposable income (Parkin 2003, p.578).

Suppose that an employee at Dell receives a Christmas bonus of €600. Assume that this individual spends €450 and saves the remaining €150. Therefore, one can ascertain that this individual’s propensity to consume is 0.75 (€450/€600).

18. Short-Run: The short run in microeconomics had two meanings. For the firm, it is the period of time in which the quantity of at least one input is fixed and the quantities of the other inputs can be varied. The fixed input is usually capital-that is, the firm has a given plant size. For the industry, the short-run is the period of time in which each firm has a given plant size and the number of firms in the industry is fixed (Parkin 2003, p.214).

Firstly, it is important to note that the short-run does not refer to a specific period of time, but rather it is a notion of flexibility. For instance, to increase output in the short-run a firm must increase the quantity of its variable inputs. Labour is often referred to as a variable input; therefore to produce more output in the short-run a firm needs only to hire more staff.

19. Real Exchange Rate: The real exchange rate (є) is the nominal exchange rate adjusted for relative prices. The real rate is a measure of whether a country is becoming more or less price competitive to trading partners over time (Leddin & Walsh 2003, p.189).

The real exchange rate (є) can be calculated as the ratio of domestic and foreign prices expressed in a common currency. The graph below illustrates the US Dollar to Brazilian Real exchange rate. From the data sourced it is possible to ascertain if one converts 1 US dollar to a Brazilian Real you will end up with a total of 1.74 Brazilian Real’s.

20. Trade Surplus: A positive balance of trade is known as a trade surplus, or in other words where a country’s net exports exceed its net imports.

Countries like Germany and China are renowned for a balance of payments surplus. However, recently Germany’s trade surplus has decreased to €15.6bn in light of a stronger Euro exchange rate (http://news.bbc.co.uk/). However, in spite of this Germany has managed to retain its position as the world’s leading exporter.

EXERCISE 3

For a government to have a self financing steady state implies to have an optimal tax level G= *. Assuming that the sum of the output of workers is the output of an economy, in the long run Y= G/ .

So, if changes it will have an inverse effect on the Y, thus if is increased Y will decrease, this could help an overheated economy and at the same time would be a fount of funds for the government to be spent in future crises on downsides in the economy.

Whereas, if is decreased, Y will actually increase, but might not be a sustainable growth because goods and services provided by the government will decrease in quantity and quality. Therefore the Y* could be changed to a lower figure.

1 comment:

Excellent summary, especially with the consumption function example.

Post a Comment